Why Smart American Buyers Are Moving Their U.S. Equity Into Puerto Vallarta

The insider’s guide to Puerto Vallarta real estate and the capital strategy most buyers never consider

By Will Walker

U.S. Equity Strategist | Mortgage Lender

Local in Puerto Vallarta

February 2026

Puerto Vallarta is no longer just a vacation destination. For informed American buyers, it has become a strategic wealth move.

After years as a licensed mortgage lender in the United States and now living and operating locally in Puerto Vallarta, I’ve seen a consistent pattern. American homeowners walk away from this market not because it lacks opportunity, but because they don’t understand the capital structure available to them.

This article breaks down:

• The real market data

• The infrastructure growth

• Neighborhood intelligence

• Rental income realities

• The U.S. equity strategy that allows qualified buyers to purchase as cash

If you own property in the United States, this may be the most important real estate conversation you have this year.

The Opportunity

Puerto Vallarta in 2025 and 2026 is experiencing a rare alignment of fundamentals:

• Expanded inventory creating negotiating leverage

• Surging tourism growth

• Major infrastructure investment

• Continued property appreciation

• Strong U.S. dollar advantage

• Increasing American migration

Prices are not low. They are rising. But the structure of this market currently favors prepared buyers.

Market Data That Demands Attention

Recent data from MLS and regional market research reveals:

• 43 percent average condo price appreciation since 2020

• $494,000 average condo sale price early 2025

• 26 percent year over year price increase

• 49 percent increase in total sales dollar volume early 2025

• 72 percent increase in new listings creating buyer leverage

• 9.6 percent international passenger growth year over year

• 3 to 7 percent projected annual property value growth

Inventory expansion is significant. Active listings have risen more than 50 percent. One and two bedroom condo inventory increased over 100 percent from 2023 to 2024.

This is not a weakening market. It is a maturing one.

Condos that averaged $275,000 in 2017 now trade above $424,000. Buyers who purchased just two years ago are seeing roughly 22 percent appreciation.

The best time to invest was yesterday. The second best time is now.

Why Puerto Vallarta

Tourism Strength

Puerto Vallarta welcomed over 6 million visitors in 2023. In the first quarter of 2024 alone, nearly 1 million international passengers arrived.

Hotel occupancy rates have exceeded 80 percent in Puerto Vallarta and nearly 87 percent in Riviera Nayarit.

Strong tourism drives strong short term rental performance.

Airport Expansion

The city is constructing a second airport terminal, expected to open in 2026. Designed to become Latin America’s first net zero airport, this expansion signals long term confidence and premium tourism growth.

Historically, major airport expansions correlate with surrounding property appreciation.

New Highway Infrastructure

After more than a decade of planning, the new bypass highway completed in 2024 dramatically reduced travel times across Banderas Bay.

Previously overlooked areas like Mezcales are now seeing increased transaction volume and buyer interest.

Currency Advantage

Properties are priced in U.S. dollars, but operating expenses, labor, and services are largely peso based.

This currency dynamic improves purchasing power and operating margins for American buyers.

American Migration

Over 1 million Americans now live in Mexico. Remote work normalization, cost of living pressures, and lifestyle migration continue accelerating demand.

The buyer base is diversified and expanding.

Neighborhood Intelligence

Zona Romántica

The most vibrant and high demand area in Puerto Vallarta. Strong pedestrian culture, beachfront proximity, and premium short term rental demand.

Typical gross short term yields: 9 to 11 percent

Marina Vallarta

Upscale marina community with strong North American demographic presence. Stable occupancy and strong long term rental demand.

Typical gross short term yields: 7 to 8.5 percent

Conchas Chinas

Luxury cliffside enclave. Primarily appreciation driven with high net worth buyer interest.

Best suited for capital preservation and long term value growth

Versalles

Emerging, centrally located, strong value play. Growing restaurant and expat infrastructure.

Typical gross short term yields: 7.5 to 9 percent

Nuevo Vallarta and Northern Corridor

Fastest growing region with new infrastructure and airport proximity. Pre construction opportunities still available under $300,000 in select projects.

Typical gross short term yields: 7 to 8 percent

Rental Income Reality

Puerto Vallarta has over 7,000 active Airbnb listings with an average occupancy rate near 59 percent annually.

Median annual gross revenue is approximately $24,000.

Well positioned properties can generate:

• One bedroom beachfront condo: $35,000 to $55,000 gross annually

• Two bedroom marina property: $28,000 to $42,000 gross annually

• Versalles studio or one bedroom: $19,000 to $30,000 gross annually

• Luxury villa: $60,000 to $150,000 plus annually

Professional management typically runs 20 to 25 percent of rental income.

In the right location, total ROI on invested capital can range between 8 and 15 percent annually.

Long term rentals provide steady income between $750 and $2,500 per month depending on size and location.

The Strategy Most Buyers Miss

The majority of Americans exploring Puerto Vallarta believe they must:

• Sell their U.S. home

• Save large cash reserves

• Or apply for financing in Mexico

None of those are required for qualified homeowners.

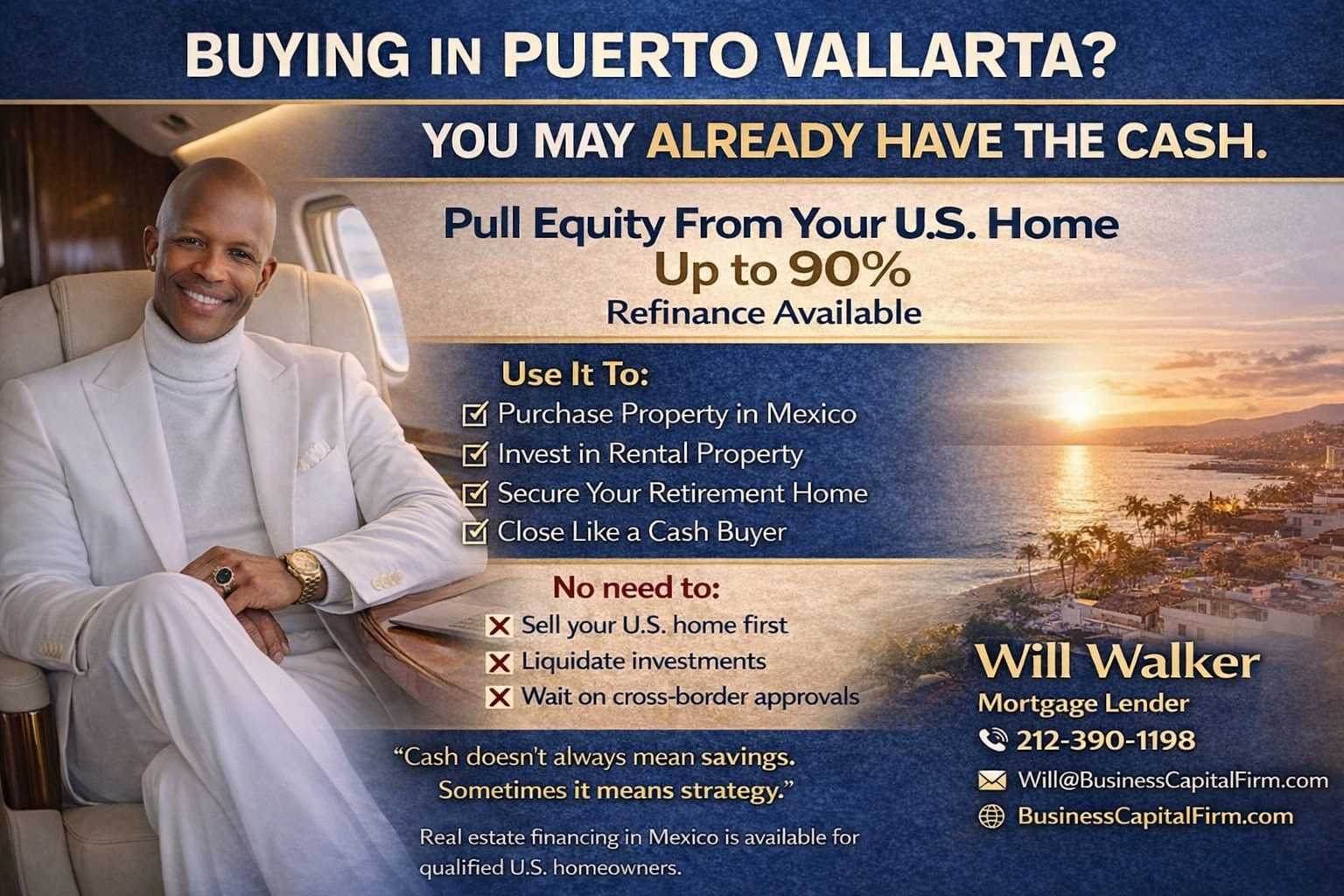

The U.S. Equity Strategy

Step 1

Assess your equity position in your U.S. property.

Step 2

Structure a cash out refinance or home equity line of credit. Qualified borrowers may access up to 90 percent loan to value.

Step 3

Use that capital to purchase in Puerto Vallarta as a cash buyer through the standard fideicomiso trust structure.

Step 4

Leverage rental income from your Puerto Vallarta property to offset or fully service the U.S. refinance payment.

This strategy keeps the financing entirely on the U.S. side. No Mexican bank approval required. No disruption to your existing U.S. financial structure.

Cash buyers negotiate differently in Puerto Vallarta.

The majority of sellers own their properties free and clear. Average days on market exceed 200 days. Sellers value certainty and speed.

CASH DELIVERS BOTH

The Long View

Property values in Puerto Vallarta have trended upward consistently since 2016.

Even during global disruptions, the market corrected in volume, not pricing.

Long term drivers include:

• Retirement migration from the United States

• Remote worker relocation

• Mexican domestic middle class expansion

• Tourism growth

• Infrastructure investment

• Foreign direct investment growth

No market is risk free. However, Puerto Vallarta’s demand base is structural, not speculative.

Your Action Plan

Before engaging a realtor or touring property, you should answer:

• How much usable equity do you have in your U.S. home

• What purchase range does that support

• What rental income is realistic in your target zone

• What does a five year financial model look like

• Does the rental income service the refinance payment

• Are there pre construction opportunities aligned with your profile

These are the conversations I have weekly with clients across the United States.

About Will Walker

I am a U.S. mortgage lender with coverage in 45 states and live locally in Puerto Vallarta.

My role is to structure the U.S. side capital solution while advising on local market dynamics.

The value is the integration of U.S. licensed financing strategy and on the ground Puerto Vallarta expertise.

Ready to Explore What’s Possible

One conversation. No obligation. Real numbers. Clear structure.

Will Walker | U.S. Equity Strategist

Contact Me To Get A Quote: 212 390 1198

Email | Will@BusinessCapitalFirm.com

BusinessCapitalFirm.com

If you own property in the United States, your next purchase in Puerto Vallarta may already be funded.